Answer: $982.48

Explanation:

The maximum price you should pay would be the present value of the bond including its cash flows. That is how the price of a bond is computed.

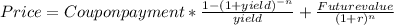

The formula to calculate the price of a bond is;

The payments are semi annual so the variables will need to be converted to semi annual variables.

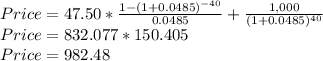

Coupon payment = 9.5% * 1,000 * 1/2

= $47.50

Number of periods = 20 years * 2 = 40 semi annual periods

Yield = 9.7%/2 = 4.85%

Price = $982.48

$982.48 should be the maximum price you should pay.

Alternatively, use a financial calculator and input the variables as;

Future Value = $1,000

Payment = $47.50

Number of Periods = 40

Rate = 4.85%