Answer:

A) $22.16 per share

B) $23.625

Explanation:

Price to be paid for the stock today is equal to the present value of expected inflows we can find price by multiplying the dividend with the growth rate then dividing it by the required rate of return.

Price = Dividend(1+growth rate) / 1+ required return

Data

Dividend = 2.7

Required return = 17%

Growth rate = 5%

1) year1 year2 year3 year3

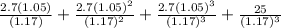

Price =

Price = $22.16 per share

2)

Price to be paid =

Price to be paid = $23.625