Answer:

Holding Period return 19.54%

Step-by-step explanation:

We purchase to get a yield of 8%

so we sovle for the present value of the bond (market value) which is the amount at which we adquire the bond:

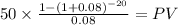

PV of the coupon payment:

C ($1,000 x 5%) 50.000

time 20 years

rate 0.08

PV $490.9074

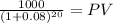

Pv of maturity:

Maturity 1,000.00

time 20.00

rate 0.08

PV 214.55

PV c $490.9074

PV m $214.5482

Total $705.4556

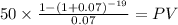

Then, we solve for the price that 7% YTM after a year:

C 50.000

time 19

rate 0.07

PV $516.7798

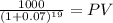

Maturity 1,000.00

time 19.00

rate 0.07

PV 276.51

PV c $516.7798

PV m $276.5083

Total $793.2881

Now we compare to get hte capital gain:

year-end less beginning value

$793.29 - $705.46 = $87.83

The coupon is also a return:

$1,000 x 5% = $50

Total return $137.83

Investment $705.46

Holding-period return

137.83/705.46 = 0,195376 = 19.54%