Answer:

$225

Explanation:

Given that:

Principal = $6,000

Interest rate = 5%

Time = 1 year

Taxes paid = 25% on the interest earned

To find:

Money earned after paying taxes ?

Solution:

First of all, let us calculate the total interest earned:

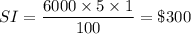

Formula for Simple Interest is given as:

Where P is the principal

R is the rate of interest

T is the time taken

Putting the given values:

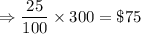

Now, it is given that 25% of the interest earned is given as taxes.

Taxes paid = 25% of $300

Therefore, the money earned = Interest earned - Taxes paid

The money earned = $300 - $75 = $225