Answer:

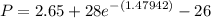

-22.42

Step-by-step explanation:

Given,

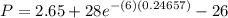

Stock = $26, Call = $2.65, Exercise price = $28, Risk-free rate = 6%, Time = 0.24657 (90 / 365)

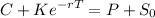

The put-call parity formula is

where:

where:

C = Call Price, K = Exercise Price, r = Risk-Free Rate, T = Time to Expiration,

P = Put Price, and

= Stock Price

= Stock Price

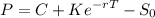

Subtracting

from both sides, we get

from both sides, we get

= -22.42