Answer:

$5.95

Step-by-step explanation:

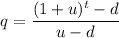

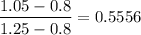

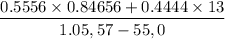

Risk neutral probability,

=

The value of stock lattice is shown below :

85.9375

68.75 55

55 44 35.2

t=0 t=1 t=2

Value of the American put option when the stock price is $85.9375 at t=2

= max(57-85.9375,0) = 0

The value of the American put option when the stock price is $55 at t=2

= max(57-55,0) = 2

The value of American put option when the stock price is $85.9375 at t=2

= max(57-35.2,0) = 21.8

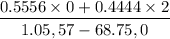

The value of a American put option when the stock price is $68.75 at t=1

= max

= $0.84656

= $0.84656

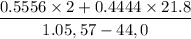

The value of the American put option when stock price is $44 at t=1

= max

= $13

= $13

The value of American put option today when the stock price is $55 at t=0

= max

= $ 5.95

= $ 5.95

Thus, the value of American put option today is $5.95