Answer:

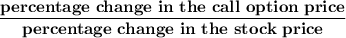

The Elasticity of the call option =

Step-by-step explanation:

From the given information:

For $1 change in stock price

the percentage of change in stock price = ΔS/S

ΔS/S = (1× 100)/47 = 2.127659574

ΔC = hedge ratio × ΔS

ΔC = 0.7 × 1

ΔC = 0.7

However , the percentage change in the stock call option price = ΔC/C

= (0.7 × 100) / 6.50

= 70/6.50

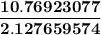

= 10.76923077

∴

The Elasticity of the call option =

The Elasticity of the call option =

The Elasticity of the call option =

OR

The Price Elasticity of the call option can be computed by using EXCEL FUNCTION(=B3*(B4/B1))

The illustration to that can be seen in the diagram attached below.

The Elasticity of the call option

5.06% by using EXCEL FUNCTION.

5.06% by using EXCEL FUNCTION.