Answer:

convexity = 37.6306

Step-by-step explanation:

given data:

maturity time = 7 years

yield to maturity (y) = 8% = 0.08

coupon bond = 6%

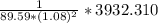

price= $89.59 ( gotten from the summation of pv(cf) from the table attached below )

t = time

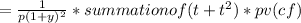

convexity can be found using this formula

=

= 37.6306

= 37.6306