Answer:

the new degree of operating leverage for output levels of 16,400 units and 14,400 units will be -0.0858 and - 0.0745 respectively.

Step-by-step explanation:

From the given information:

the degree of operating the leverage at 415,400 units =

where contribution margin = 2 × 58000 =116000

If we assume that the sales price should be p and the variable cost be q per unit .

Then, 415,400p - 415,400q = 116000

p - q =

p - q = 0.279 at 415400 unit

Contribution margin = 415400 × 0.279

Contribution margin = 115896.6

The operating income = contribution margin - fixed expense

58000 = 115896.6 - fixed expense

fixed expense = 115896.6 - 58000

fixed expense = 57896.6

However, when the output level is 16400 unit,

the contribution margin = 16400(p-q)

the contribution margin = 16400(0.279)

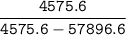

the contribution margin = 4575.6

The operating leverage =

The operating leverage =

The operating leverage =

The operating leverage = -0.0858

when the output level is 14400 unit,

the contribution margin = 14400(p-q)

the contribution margin = 14400(0.279)

the contribution margin = 4017.6

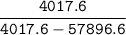

The operating leverage =

The operating leverage =

The operating leverage =

The operating leverage = - 0.0745