Answer:

the company should not buy the machine.

Step-by-step explanation:

Given that:

cost of the new machine = $38000

lifespan = 8 years

constant income = 5,000

Interest = 1.7%

no of days = 365

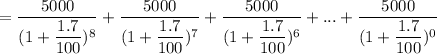

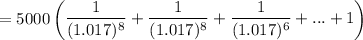

The value of earning at the time of buying can be calculated as follows:

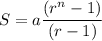

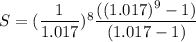

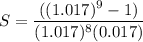

Sum of a Geometric progression

S = 8.4211

The value of earning at the time of buying = (5000 × 8.4211)-$5000

The value of earning at the time of buying = $42105.5 -$5000

The value of earning at the time of buying = $37105.5

The Machine price = $38000

If the value - Machine price > 0, then the company should buy the machine

∴

= $ 37105.5 - $38000

= -$ 894.5

Since the value is negative which is less than zero, then the company should not buy the machine.