Answer: 4%

Step-by-step explanation:

Abnormal returns are the excess actual returns received over the expected return.

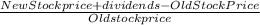

The actual return can be calculated as;

=

=

= 30%

The expected return according to CAPM;

Expected return = Risk free rate + beta( market return - risk free rate)

= 16% + 1 ( 26% - 16%)

= 26%

Abnormal return = 30% - 26%

= 4%