Answer: a. 2.44%

b. 0.001070%

Step-by-step explanation:

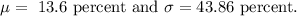

Given: The returns from an asset are normally distributed with

Let x be the percentage value of return.

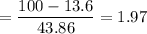

a. Double in value in a single year i.e. 100% return.

z-value =

Required probability = Right-tailed probability for Z = 1.97

= 0.0244 [By p-value calculator]

= 2.44%

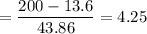

b. Triple in value in a single year i.e. 200% return.

z-value =

Required probability = Right-tailed probability for Z =4.25

= 0.0000107 [By p-value calculator]

= 0.001070%