Answer:

The company's cost of capital will be "13%".

Step-by-step explanation:

The given values are:

Risk free rate

= 5

Beta

= 1.25

Market risk premium

= 8

Now,

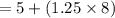

⇒

On substituting the estimated values, we get

⇒

⇒

The total value will be:

=

= $

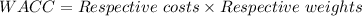

As we know,

⇒

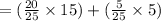

⇒

⇒

⇒

Note: % = percent