Answer:

a

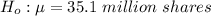

The null hypothesis is

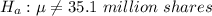

The alternative hypothesis

b

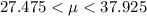

The 95% confidence interval is

Explanation:

From the question the we are told that

The population mean is

The sample size is n = 30

The sample mean is

The standard deviation is

Given that the confidence level is

then the level of significance is mathematically represented as

then the level of significance is mathematically represented as

=>

Next we obtain the critical value of

from the normal distribution table

from the normal distribution table

The value is

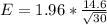

Generally the margin of error is mathematically represented as

substituting values

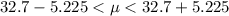

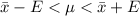

The 95% confidence interval confidence interval is mathematically represented as

substituting values