Answer:

All the requirements are solved below

Step-by-step explanation:

Purchase = $178,000

Ready to use cost = $2,480

Installation cost = $1,160

Salvage value = $14,000

Depreciation method = Straight line

Useful life = 6 years

Solution

Requirement A If sold for $22,000

Entry DEBIT CREDIT

Cash $22,000

Accumulated depreciation $140,000

Profit/loss on disposal $20,000

Machinery $182,000

Requirement B If sold for $88,000

Entry DEBIT CREDIT

Cash $82,000

Accumulated depreciation $140,000

Profit/loss on disposal $40,000

Machinery $182,000

Requirement C If destroyed in fire and insurance company paid $32,500

Entry DEBIT CREDIT

Cash $30,000

Accumulated depreciation $140,000

loss from fire $12,000

Machinery $182,000

Workings

Cost =$178,000 + $2,480 + $1,160

Cost = $182,000

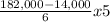

Accumulated depreciation = (

Accumulated depreciation = 140,000