Answer: 7.48%

Step-by-step explanation:

Weighted Average Cost of capital is simply the weighted average of the costs of equity and debt.

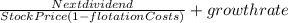

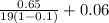

Cost of Equity

=

=

= 9.80%

Cost of debt

= Interest ( 1 - Tax)

= 0.075 (1 - 0.40)

= 4.65%

WACC = 9.80% * 0.55 + 4.65% * 0.45

= 7.48%