Answer: $3,338.56.

Step-by-step explanation:

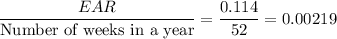

Given, EAR = 11.4 percent =0.114

Weekly interest rate=

Growth rate of price of flowers = 3.3 % per year

Weekly growth rate=

Star Cost (C)= $6

Time period (t)= 25 years

= 25 x 52 = 1300 weeks

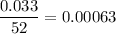

Required formula for growing annuity :

![PV=(C)/(r-g)[1-((1+g)/(1+r))^t]](https://img.qammunity.org/2021/formulas/business/college/94iz9pfkp419mgsmb29bh8z3z7uaurifr2.png) ,

,

where C = Star cost

r = rate per period

g= growth rate

t = time period

![PV=(6)/(0.00219-0.00063)[1-((1+0.00063)/(1+0.00219))^(1300)]\\\\=(6)/(0.00156)[1-(0.998443408934)^(1300)]\\\\=(3846.15384615)[1-0.13197471131]\\\\=(3846.15384615)(0.86802528869)\approx\$3338.56](https://img.qammunity.org/2021/formulas/business/college/tynh77fxbjvdiofq265vejxgqles6hh58z.png)

Hence, the present value of this commitment = $3,338.56.