Answer:

B. A portfolio variance is dependent upon the portfolio's asset allocation.

Step-by-step explanation:

A portfolio variance is used to determine the overall risk or dispersion of returns of a portfolio and it is the square of the standard deviation associated with the particular portfolio.

Hence, the correct statement among the options given is that, a portfolio variance is dependent upon the portfolio's asset allocation.

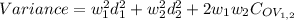

The portfolio variance is given by the equation;

Where;

= the weight of the nth security.

= the weight of the nth security.

= the variance of the nth security.

= the variance of the nth security.

= the covariance of the two security.

= the covariance of the two security.