Answer: 9.08%

Step-by-step explanation:

Using the Gordon Growth model, a required return on a stock can be calculated if the stock price, next dividend and constant growth rate is given.

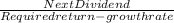

Stock Price =

37 =

37(r - 0.04) = 1.88

r - 0.04 = 1.88/37

r = 1.88/37 + 0.04

r = 9.08%