Answer:

The probability that the insurer pays at least 1.44 on a random loss is 0.18.

Explanation:

Let the random variable X represent the losses covered by a flood insurance policy.

The random variable X follows a Uniform distribution with parameters a = 0 and b = 2.

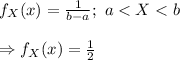

The probability density function of X is:

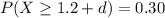

It is provided, the probability that the insurer pays at least 1.20 on a random loss is 0.30.

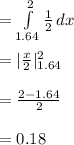

That is:

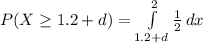

⇒

The deductible d is 0.20.

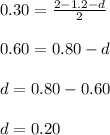

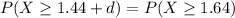

Compute the probability that the insurer pays at least 1.44 on a random loss as follows:

Thus, the probability that the insurer pays at least 1.44 on a random loss is 0.18.