Answer:

(A) The odds that the taxpayer will be audited is approximately 0.015.

(B) The odds against these taxpayer being audited is approximately 65.67.

Explanation:

The complete question is:

Suppose the probability of an IRS audit is 1.5 percent for U.S. taxpayers who file form 1040 and who earned $100,000 or more.

A. What are the odds that the taxpayer will be audited?

B. What are the odds against such tax payer being audited?

Solution:

The proportion of U.S. taxpayers who were audited is:

P (A) = 0.015

Then the proportion of U.S. taxpayers who were not audited will be:

P (A') = 1 - P (A)

= 1 - 0.015

= 0.985

(A)

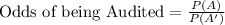

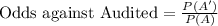

Compute the odds that the taxpayer will be audited as follows:

Thus, the odds that the taxpayer will be audited is approximately 0.015.

(B)

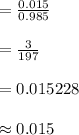

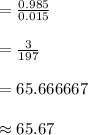

Compute the odds against these taxpayer being audited as follows:

Thus, the odds against these taxpayer being audited is approximately 65.67.