Answer:

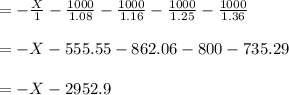

The answer is "21,622.98".

Step-by-step explanation:

In the given question some information is missing, which can be defined in the given attachment.

To calculate the first cost we first subtract B cost is to X.

NPV = Cash Flow of the sum of PV amount

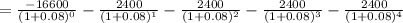

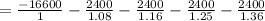

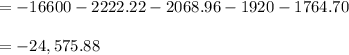

The value of Option A or NPV = -24,575.88

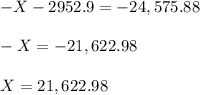

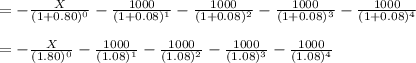

The value of Option B or NPV:

The value of Option B or NPV = -X -2952.9

As demanded

In Option B the value of NPV = In Option A the value of NPV