Answer:

This driver's insurance premium should be at least $990.43.

Explanation:

We are given that the probability of a driver getting into an accident is 6.4%, the average cost of an accident is $13,991.05, and the overhead cost for an insurance company per insured driver is $95.

As we know that the expected cost that the insurance company has to pay for each of driver having met with the accident is given by;

The Expected cost to the insurance company = Probability of driver getting into an accident

Average cost of an accident

Average cost of an accident

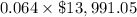

So, the expected cost to the insurance company =

= $895.43

Also, the overhead cost for an insurance company per insured driver = $95. This means that the final cost for the insurance company for each driver = $895.43 + $95 = $990.43.

Hence, this driver's insurance premium should be at least $990.43.