Answer:

the opportunity cost of capital in this case is 8%

Step-by-step explanation:

From the information given :

Elinor is asked to invest $5100 in a friend's business with the promise that the friend will repay $5610 in one year.

Eleanor finds her best alternative to this investment, with similar risk, is one that will pay her $5508 in one year.

U.S. securities of similar term offer a rate of return of 7%.

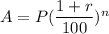

The opportunity cost of capital can be determined by using the expression:

where;

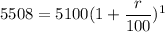

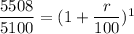

A = amount = $5508

P = Principal = $5100

r = opportunity cost of capital = ???

n = number of years = 1 year

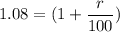

1.08 × 100 = 100 + r

108 = 100 + r

r = 108 - 100

r = 8%

Therefore; the opportunity cost of capital in this case is 8%