Answer:

A) Market Value: $1,251.2220

B) Market Value: $898.94

C) the price of the bonds will decrease over time. As the nominal amount will suffer from less discounting over time at maturity will match the nominal amount of $ 1,000. To do so It need to decrease over time.

Step-by-step explanation:

The value of the bonds will be the present value of the future coupon payment and maturity at the new rate of 6%

PV of the coupon payment

C 50.000 (1,000 x 10% / 2 ayment per year)

time 16 (8 year to maturity x 2 payment per year)

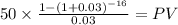

rate 0.03 (6% over two payment per year)

PV $628.0551

PV of the maturity

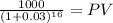

Maturity 1,000.00

time 16.00

rate 0.03

PV 623.17

PV c $628.0551

PV m $623.1669

Total $1,251.2220

If the rate is 12%

PV of the coupon payment:

C 50.000

time 16

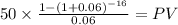

rate 0.06

PV $505.2948

PV of the maturity:

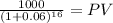

Maturity 1,000.00

time 16.00

rate 0.06

PV 393.65

PV c $505.2948

PV m $393.6463

Total $898.9410