Answer:

a) c. $4.34

b) b. $4.10

Step-by-step explanation:

a) Find Farewell's diluted earnings per share for 2021.

Use the formula below:

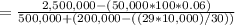

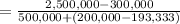

Diluted EPS = (Net income after tax - preferred dividend) / diluted common stock

Diluted EPS = $4.34 per share

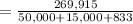

b) stock options = 5,000

Value in current shares = 500,000/12 = $4,167

Diluted shares = 5000 - 4167 = 833

Use the formula below to find the diluted earnings per share:

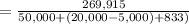

Diluted EPS = Net income/share outstanding

Diluted EPS = $4.10 per share