Answer:

Bob's home will worth $296,779.25 after 12 years.

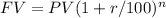

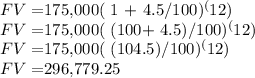

Equation used is

Explanation:

Current value of Bob's house =

market is improving at 4.5% annually.

This, means that the value of house gets appreciated by 4.5% each year from its previous year value.

This is a problem of compound interest formula

where PV is the present value of any thing

FV is the future value

r is the annual rate of interest

t is the time in number of year for which rate is applicable.

_____________________________________

Given

PV = $175,000.

r = 4.5%

t = 12 years

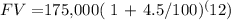

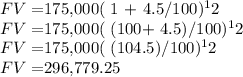

Value after 12 year will be given by

Thus, Bob's home will worth $296,779.25 after 12 years.

Equation used is