Answer:

The net income will be "$36,250".

Step-by-step explanation:

The given values are:

Administrative expenses

= $15,000

Fixed overhead costs

= $30,000

According to the question:

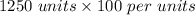

The sales will be:

=

=

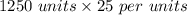

The production cost of the variable will be:

=

=

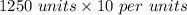

Variable selling will be:

=

=

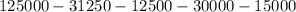

The net income will be:

⇒

On substituting the values, we get

⇒

⇒

($)

($)