Answer:

a. Days Sales Outstanding

Time taken on average for customers to pay.

= (40% * 10 days) + (60% * 84 days)

= 54.4 days

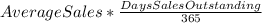

b. Average Receivables =

=838,000 *

= $124,896.44

c. 0% because if they take the discount they do not incur the cost.

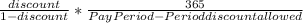

d. Nominal Cost =

=

= 15.25%

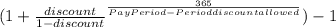

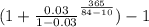

Effective Cost =

=

= 16.21%

e. Days Sales Outstanding = (40% * 10 days) + (60% * 40 days)

= 28 days

Average Receivables =

= $64,284.93