Complete Question

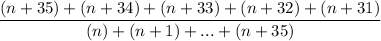

Consider a three-year loan (so we'll assume the numbers 1 through 36) for $5,000 with interest at 10% per year. Using standard amortization, the monthly payment is $161.33. In this example, we will not worry about exact or ordinary interest because the total interest to be paid is $808.13. After the fifth month the borrower decides to prepay the whole loan. Under a standard amortization plan the borrower would have paid $198.28 in cumulative interest. However, using the Rule of 78 a lender would calculate the fraction of the total interest based on two series:

Answer:

See below

Explanation:

36+35+34+33+32=170

- If you add 36, 35, 34, 33, and 32, the sum is 170.

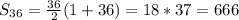

Now, 1,2,3,...36 forms an arithmetic series whose first and last term are 1 and 36 respectively. Its sum is determined using the formula:

- If you sum the numbers from 1 to 36, the sum is 666.

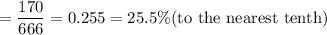

- The fraction (the first sum / the total sum) to the nearest tenth = 25.5%.

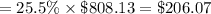

The lender will multiply this fraction by the total interest.

- The cumulative interest

The difference between the amount paid under a standard amortization plan and the amount paid under a Rule of 78 plan is:

$206.07-198.28=$7.79