Answer:

A)grow = 6.33%

Nxt year dividends(rounded to nearest cent): $4.31

B) The firm receives 93% (1 - flotation cost) of the market value of the shares so It receives the 42.06 per share

C) stock return 15.86%

D) required rate of return (with flotation): 16.57%

Step-by-step explanation:

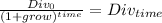

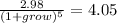

We solve for the constant grow rate:

![grow= \sqrt[5]{4.05/2.98} -1](https://img.qammunity.org/2021/formulas/business/high-school/w9tbruoy85s4jiuc69dwg043gkd4o3ea17.png)

grow= 0.063280262

Dividends for the sixth year:

4.05 x (1.0633) = 4,306365

42.06 / (1 - flotation cost) = 45.23

flotation cost = 1 - 42.06 / 45.23 = 0.07 = 7%

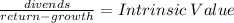

rate of return without flotation:

4.31/45.23 + 0.0633 = 0.158590736 = 15.86%

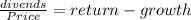

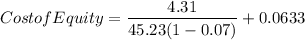

solving for return considering the existence of flotation cost:

D1 4.31

P 45.23

f 0.07

g 0.0633

Ke 0.165763157 = 16.57%