Answer:

1. Point estimate M (sample mean): 83.33

2. The lower bound is $73.36 and the upper bound is $93.30. One can be______% confident that the mean travel tax for all cities is between these values.

3. A. The researcher could decrease the level of confidence.

Explanation:

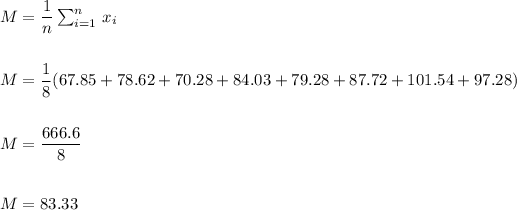

A point esimate for the population mean travel tax can be done with the sample mean.

We can calculate the sample mean as:

2. We have to calculate a 95% confidence interval for the mean.

The sample mean is M=83.33.

The sample size is N=8.

The population standard deviation is not known, so we have to estimate it from the sample standard deviation and use a t-students distribution to calculate the critical value.

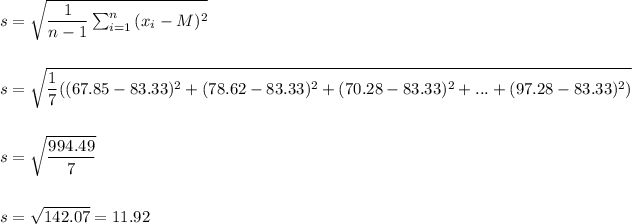

We calculate the sample standard deviation as:

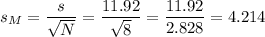

The standard error is:

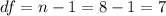

The degrees of freedom for this sample size are:

The t-value for a 95% confidence interval and 7 degrees of freedom is t=2.36.

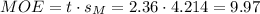

The margin of error (MOE) can be calculated as:

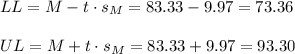

Then, the lower and upper bounds of the confidence interval are:

The 95% confidence interval for the mean travel tax is (73.36, 93.30).

We can be 95% confident that the true mean travel tax is within this interval.

3.. If we have no access to additional data, we can not decrease the standard deviation or increase the sample size.

The only way to have a narrower confidence interval is decreasing its level of confidence. With the same sample information, the lower the confidence, the narrower is the interval.