Answer:

30.51%

Step-by-step explanation:

The computation of the standard deviation is shown below:

Data provided in the question

Weightage in IBM = 30% = WI

Weightage in MFST = 100 - 30% = 70% = WM

The Volatility in IBM = 35% = VI

The Volatility in MFST = 30% = VM

Correlation = 0.5 = C

Based on the above information

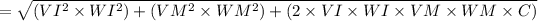

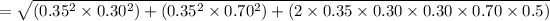

The standard deviation is

= 30.51%