Answer:

a pumping plan (pump water from a closer water source to the city) is prefered.

the breakeven investment cost in year 10 is $1311018. 802 in order to make these two projects equally preferable

Step-by-step explanation:

From the given information; we are to :

(a) Use an annual cash flow analysis to find out which plan is preferred

(b) What is the breakeven investment cost in year 10 to make these two projects equally preferable?

The two plans selected by the engineer are:

a gravity-based plan (divert water from the Sierras and pipe it by gravity to the city)

a pumping plan (pump water from a closer water source to the city).

In order to achieve that; let's find out the Present Value for each plan.

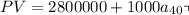

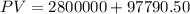

The Present Value (PV) of cost related to a gravity-based plan is:

at 10%

at 10%

PV = $2897790.5

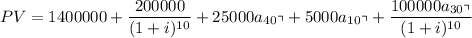

The Present Value (PV) of cost related to a pumping plan

at 10%

at 10%

PV = 1400000 + 77108.66 + 244476.27 + 307228.36+363448.36

PV = $2392261.65

Thus; we consider the PV with lower value in order to determine which plan is prefered.

Thus; a pumping plan (pump water from a closer water source to the city) is prefered.

(b).

What is the breakeven investment cost in year 10 to make these two projects equally preferable

Let assume that I = the break even investment cost in year 10 for the prefered pumping plan.

Then;

$2897790.5 = $2392261.65 + (I/(1+i)¹⁰) at 10%

$2897790.5 - $2392261.65 = (I/(1+i)¹⁰) at 10%

$505528.85 = (I/(1+i)¹⁰) at 10%

0.3856 I = 505528.85

I = 505528.85/0.3856

I = $1311018.802

Thus; the breakeven investment cost in year 10 is $1311018.802 in order to make these two projects equally preferable