Answer:

Annual Interest Rate, r = 5.69%

Explanation:

Amount of loan taken = 220,000

Closing fee is 5% of the loan value

Closing fee = 5% of 222,000 = 0.05 * 220000 = 11000

Therefore, Principal, P = Loan amount + closing fee

P = 220000 + 11000

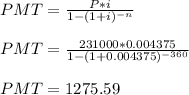

P = 231, 000

Annual rate, r= 5.25% = 0.0525

Monthly rate, i = 0.0525/12 = 0.004375

Time, n = 30 years = 30*12 = 360 months

The monthly payment will be calculated by:

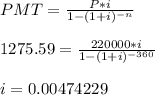

Assuming payments are made based on 220,000, let us calculate the monthly interest rate.

Annual rate, r = 12 * 0.0047429

r = 0.0569 = 5.69%