Answer:

The completely stated question and the multiple-choice answers include:

Latting Corporation has entered into a 7-year lease for a building it will use as a warehouse. The annual payment under the lease will be $4,781. The first payment will be at the end of the current year and all subsequent payments will be made at year-end. If the discount rate is 6%, the present value of the lease payments is closest to:

A. $31,573

B. $22,257

C. $33,467

D. $26,688

The correct answer is: $26,688 (D)

Step-by-step explanation:

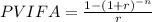

First of all, we have to calculate the Present Value Interest Factor of an Annuity (PVIFA), which is the factor that can be used to calculate a series of annuities. The formula for PVIFA is given by:

where:

r = interest rate per period

n = number of periods.

There are also existing PVIFA tables for already calculated PVIFA at different interest rates per period, and at a periodic interest (discount) rate of 6% for 7 years, the PVIFA = 5.5824

Therefore the Present value is calculated thus:

Annual payments × PVIFA for 7 years at 6%

4,781 × 5.5824 (refer to the PVIFA table)

= 26,689.45 (closest to 26,688)