Answer:

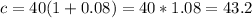

The final cost would be $43.2

Explanation:

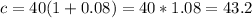

For this case from the notation given we know that the final cost is given by C and the formula is:

Where C is the final cost, p the price of the item before tax and r the tax on fraction. And for this case we want to find the final value with 8% of tax so we can do the following operation:

The final cost would be $43.2