Answer:

a.

b.

Step-by-step explanation:

Given

Total Reserves = $150 billion

Required Reserves = 8%

Required

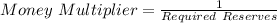

- Money Multiplier

- Money Supply

- Money Supply and Money Multiplier when Required Reserves is 12.5%

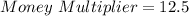

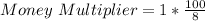

Money Multiplier is calculated as follows;

When required reserves = 8%

Convert percentage to fraction

Convert Divide to Multiplication

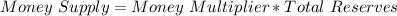

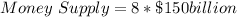

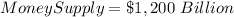

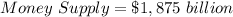

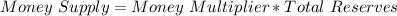

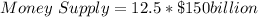

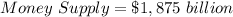

Money Supply is calculated as thus;

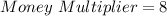

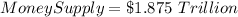

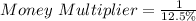

Calculating Money Supply and Money Multiplier when Required Reserves is 12.5%

Using the same formula used above

When required reserves = 12.5%

Convert percentage to fraction

Convert Divide to Multiplication

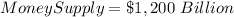

Money Supply is calculated as thus;