Answer:

Part A:

First option leasing:

Second option financing:

The slope of the second option is greater than the first option meaning that monthly payments are greater for the second option as compared to the first option.

The y-intercept of the first option is greater than the second option meaning that the initial payment of the first option is much greater than the second option.

Part B:

As you can see in the graph, the second option is better when x is less than 24 months and the first option is better when x is greater than 24 months.

The second option has less initial payment but greater monthly payment that is why it is better for the short term (for less number of months)

On the other hand, the first option has a greater initial payment but less monthly payment that is why it is better for the long term (for greater number of months)

Explanation:

Part A:

First option leasing:

The standard slope-intercept form is given by

Convert the given equation into slope-intercept form.

where x represents the number of months of ownership and y represents the total paid for the car after ‘x' months and 250 is the slope that indicates the rate of change of y with respect to x.

Second option financing:

We are given two points,

The slope m is given by

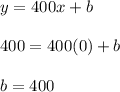

To find the value of the y-intercept (b),

substitute

So the equation of the second option is

Comparison:

The slope of the second option is greater than the first option meaning that monthly payments are greater for the second option as compared to the first option.

The y-intercept of the first option is greater than the second option meaning that the initial payment of the first option is much greater than the second option.

Part B:

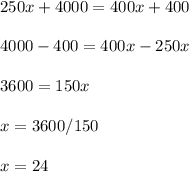

Refer to the attached graph,

The point of intersection is obtained when we equate both equations,

x = 24 months is the break-even point meaning that at this point both options are equally good.

As you can see in the graph, the second option is better when x is less than 24 months and the first option is better when x is greater than 24 months.

The second option has less initial payment but greater monthly payment that is why it is better for the short term (for less number of months)

On the other hand, the first option has a greater initial payment but less monthly payment that is why it is better for the long term (for greater number of months)