Answer:

Hello from your question there is a mix up of the figures for the BTCF AFTER 2 years and the BTCF given in the table so i would work with the value contained in the table i.e ( 25579 )

answer : 71052

Step-by-step explanation:

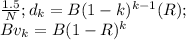

Declining balance amount can be expressed/calculated using this formula a

also R = 1.5 / 5 = 0.3 , k = 2 years

also R = 1.5 / 5 = 0.3 , k = 2 years

therefore Bv

= 20000 ( 1 - 0.3

= 20000 ( 1 - 0.3

= 9800

= 9800

Mv = 25579

Recapturing depreciation = Mv - Bv = 25579 - 9800 = 15779

BTCF is calculated as = ( capital investment + GI - expense incurred )

TI = GI - Expense - Depreciation + Depreciation recapture + capital gain

ATCF = BTCF - taxes

taxes = TI (l)

The future worth of the after-tax cash flow at the end of Year 2

Fw = -20000(f/p,12%,2) + 36600(f/p,12,1) + 35880 + 19268

= -20000(1.2544) + 36600(1.1200) + 55148 = 71052

attached below is the complete table used for the calculation