Answer:

The final cost is $43.2

Explanation:

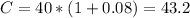

We have the following equation:

Where C is the final cost, p is the price before tax and r is the tax rate.

So, to calculated the final cost for a $40 item after 8% tax, we need to replace p by 40 and r by 0.08 and calculate the value of C as:

Therefore, the final cost is $43.2