Answer:

current price P = $ 52.81

The expected price of the stock after one year = $57.16

The Total expected return for any investor after one year = 12%

Step-by-step explanation:

Given that:

Dividend paid in 1 year = $2/ share

Dividend paid in 2 years = $4/share

Expect growth rate of the dividends g = 5% = 0.05

Expected rate of return on the stock r =12% = 0.12

Required:

a. What is the current price of the stock?

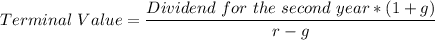

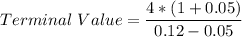

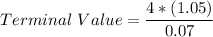

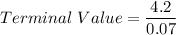

To calculate the current price of the stock ; we need to first determine the terminal value of the stock which can be done by using the formula:

Terminal value = $60

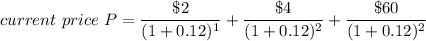

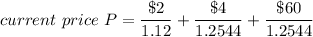

Now; the current price of the stock is calculate as follows:

current price P = $1.79 + $3.19 + $47.83

current price P = $ 52.81

b) What is the expected price of the stock in a year?

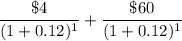

The expected price of the stock after one year =

The expected price of the stock after one year = $3.58 + $53.58

The expected price of the stock after one year = $57.16

c. Show that the expected return, 12%, equals dividend yield plus capital appreciation.

We understand now that the current price of the sock = $52.81

and the expected price of the stock after one year = $57.16 ; so any investor who purchased the stock at the current price will receive a dividend of $2 after one year.

Hence;

The Total expected return for any investor after one year =( (price after one year - current price ) + Dividend received) /current price

The Total expected return for any investor after one year =( ($57.16 - $52.81)+ $2 )/$52.81

The Total expected return for any investor after one year = ($4.35+$2)/$52.81

The Total expected return for any investor after one year = 0.12

The Total expected return for any investor after one year = 12%