Answer:

a) The null and alternative hypothesis are:

b) If 300 families were sampled, for a significance level of 5%, there is enough evidence to support the claim that a smaller proportion of American families own stocks or stock funds this year than 10 years ago (P-value = 0.001).

Explanation:

The claim that we want to have evidence to support is that a smaller proportion of American families own stocks or stock funds this year than 10 years ago.

The hypothesis for this test should state:

- For the null hypothesis, that the population proportion is not significantly different from 53%.

- For the alternative hypothesis, that the population proportion is significantly less than 53%.

If 300 families are sampled, we can perform a hypothesis test for a proportion.

The claim is that a smaller proportion of American families own stocks or stock funds this year than 10 years ago.

Then, the null and alternative hypothesis are:

The significance level is 0.05.

The sample has a size n=300.

The sample proportion is p=0.44.

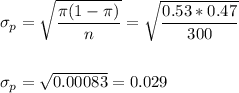

The standard error of the proportion is:

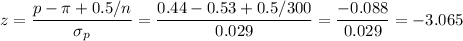

Then, we can calculate the z-statistic as:

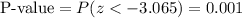

This test is a left-tailed test, so the P-value for this test is calculated as:

As the P-value (0.001) is smaller than the significance level (0.05), the effect is significant.

The null hypothesis is rejected.

There is enough evidence to support the claim that a smaller proportion of American families own stocks or stock funds this year than 10 years ago.