Answer:

$5,170,940.17

Step-by-step explanation:

The computation of the value of the firm is shown below:

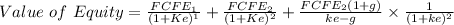

As we know that

where,

FCFE = Free cash flow of equity

ke = cost of equity

g = growth rate

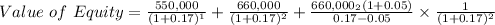

So,

= $470,085.47 + $482,138.94 + $4,218,715.76

= $5,170,940.17

This is the answer but the same is not provided in the given options

We simply applied the above formula so that the value of the firm could come