The missing part of the question is shown in bold format.

You have $10,000 cash which you want to invest. Your alternatives are either a nontaxable municipal bond paying 9% or a taxable corporate bond paying 12%. Your marginal tax rate is 30% for both ordinary income and capital gains. You expect the rate of inflation to be 6% during the investment period. You can buy a high grade municipal bond costing $10,000 which pays interest of 9% per year. This interest is not taxable. A comparable high grade corporate bond is also available that is just as safe as the municipal bond paying interest rate of 12% per year. This interest is taxable as ordinary income. Both bonds mature at the end of year 5.

Determine the real (inflation - free ) rate of return of each bond

Answer:

the inflation free rate of return of the nontaxable municipal bond is 2.8%

the inflation free rate of return of the taxable corporate bond is 5.0%

Step-by-step explanation:

Given that :

A nontaxable municipal bond pays an interest of 9% annually

A taxable corporate bond pays an interest of 12% annually

The marginal tax rate = 30% for both ordinary income and capital gains

The rate of inflation f = 6%

Determine the real (inflation - free ) rate of return of each bond

The inflation free rate of return can be determined by using the formula:

where;

r = inflation free rate of return

so;

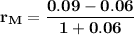

For the inflation free rate of return of the nontaxable municipal bond

; we have;

; we have;

Thus; the inflation free rate of return of the nontaxable municipal bond is 2.8%

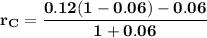

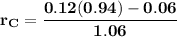

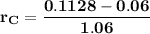

The inflation free rate of return of the taxable corporate bond is as follows:

Thus; the inflation free rate of return of the taxable corporate bond is 5.0%