Answer:

$22.81

Step-by-step explanation:

We can easily calculate share price for BeeGood company just by multiplying the current earnings per share with an average P/E ration of competitors

P/E = Price earning ratio

EPS = Earning per share

Formula: Share price = PE x EPS

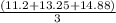

Share price =

x $1.74

x $1.74

Share price = $22.81