Answer:

B. 0.835

Explanation:

We can use the z-scores and the standard normal distribution to calculate this probability.

We have a normal distribution for the portfolio return, with mean 13.2 and standard deviation 18.9.

We have to calculate the probability that the portfolio's return in any given year is between -43.5 and 32.1.

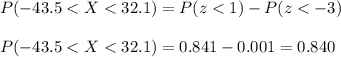

Then, the z-scores for X=-43.5 and 32.1 are:

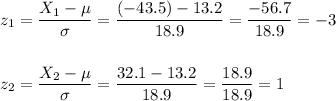

Then, the probability that the portfolio's return in any given year is between -43.5 and 32.1 is: