The missing texts where highlighted in bold format.

Marilyn has a biweekly gross pay of $810 and claims 3 federal withholding allowances. Marilyn has all of the following deductions from her gross pay: federal tax from the following table

Social Security tax that is 6.2% of her gross pay

Medicare tax that is 1.45% of her gross pay

state tax that is 21% of her federal tax

Determine how Marilyn’s net pay will be affected if she increases her federal withholding allowances from 3 to 4.

a. Her net pay will increase by $15.00.

b. Her net pay will decrease by $15.00.

c. Her net pay will increase by $18.15.

d. Her net pay will decrease by $18.15.

Answer:

c. Her net pay will increase by $18.15.

Explanation:

From the given information; we can compute the deduction on her gross pay.

given that;

gross pay = $810

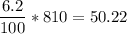

Social Security tax that is 6.2% of her gross pay

i.e

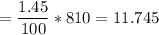

Medicare tax that is 1.45% of her gross pay

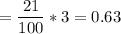

state tax that is 21% of her federal tax

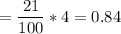

we are given that her federal withholding allowance is 3

%

%

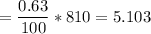

The state tax that is 0.63% of her gross pay

The total deducted amount of Marilyn’s gross pay = 50.22 + 11.745 + 5.103 = 67.068 of his gross pay

= 810 - 67.068 = 742.932

However; the question proceeds by saying ; if she increases her federal withholding allowances from 3 to 4; we should Determine how Marilyn’s net pay will be affected.

SO;

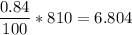

If the federal withholding allowance is 4

Then;

%

%

The state tax that is 0.84% of her gross pay

=

Thus; from the foregoing :

c. Her net pay will increase by $18.15.