Answer:

The probability that Actuary Rahul examines fewer policies than Actuary Toby is 0.2857.

Explanation:

It is provided that the automobile policies are separated into two groups: low-risk and high-risk. Actuary Rahul examines low-risk policies, continuing until a policy with a claim is found and then stopping. Actuary Toby follows the same procedure with high-risk policies.

The probability that a low-risk policy has a claim is, P (L) = 0.10.

The probability that a high-risk policy has a claim is, P (H) = 0.20.

For positive integer n, the probability that Actuary Rahul examines exactly n policies is:

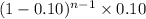

P (Actuary Rahul examines exactly n policies) =

The probability that Actuary Toby examines more than n policies is:

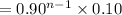

P (Actuary Toby examines more than n policies) =

It is provided that the claim statuses of policies are mutually independent.

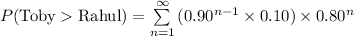

Compute the probability that Actuary Toby examines more policies than Actuary Rahul as follows:

Thus, the probability that Actuary Rahul examines fewer policies than Actuary Toby is 0.2857.