Answer:

YTM = 6.51%

YTC = 6.40%

Step-by-step explanation:

We need to solve using excel goal seek or bond formulas to generate the yield (interest rate) which matches the future couponb and maturity payment with the current selling price of the bond:

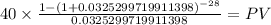

Present value of the coupon

C 40.000 (1,000 x 8% / 2 payment per year)

time 28 (14 years x 2 payment per year)

rate 0.032529972 (generate using goal seek tool)

PV $727.8688

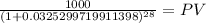

Pv of the maturity (lump sum)

Maturity 1,000.00

time 28.00

rate 0.032529972

PV 408.06

PV c $727.8688

PV m $408.0612

Total $1,135.9300

As this is a semiannual rate we multiply it by 2

0.032529972 x 2 = 0.065059944 = 6.51%

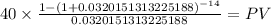

We repeat the procedure with changing the time and end-value to adjust for the callabe conditions:

C 40.000

time 14 (7 years x 2 payment per year)

rate 0.032015131

PV $445.6984

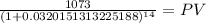

Maturity 1,073.00 (call price)

time 14.00

rate 0.032015131

PV 690.23

PV c $445.6984

PV m $690.2316

Total $1,135.9300

Againg his will be a semiannual rate so we multiply by two:

0.032015131 x 2 = 0.064030263 = 6.40%